Tax Registration

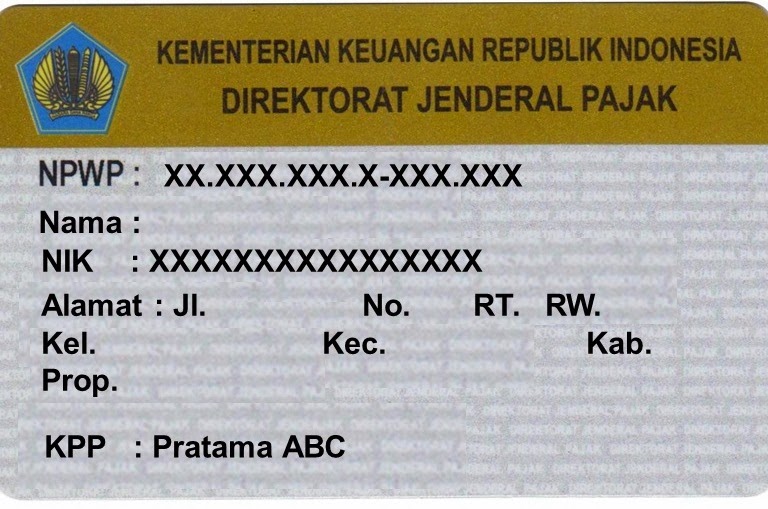

The Indonesian tax office (Direktorat Jenderal Pajak) requires all resident individuals in Indonesia to have their own personal tax numbers, Nomor Pendaftaran Wajib Pajak or NPWP.

The tax office requires all expatriates resident in Indonesia to register with the tax office and obtain their own separate tax number (NPWP) and pay monthly income taxes, file annual tax returns, and pay tax on their income earned outside Indonesia, less tax paid in other jurisdictions on the additional overseas income.

How to register ?

Taxpayers must register at the Tax Service Office in your city of residence.

Documents needed for tax registration :

- a completed registration form

- photocopy of first page of your passport

- photocopy of KITAS Stamp in your passport

- photocopy of your KITAS

- photocopy of your work permit (IMTA)

- photocopy of your employer’s NPWP

- Letter of Authorization, authorizing your representative to register and handle your tax matters.

Once you register, you will get your tax number (NPWP) within 5 working days. You will need this number later for tax yearly report.

Where to Register ?

Jakarta Area

Expats living in Jakarta are required to register with the Tax Office for Foreign Bodies and Expatriates (KPP BADORA).

Address : Jl. Taman Makam Pahlawan Kalibata, Daerah Khusus Ibukota Jakarta, Indonesia

Serpong Area

Expat living in Serpong are required to register with the Tax Office Serpong Pratama (KPP Serpong Pratama).

Address : Jalan Raya Serpong Sektor VIII Blok 405 No. 4, BSD, Tangerang, 15310

Last updated :

SOCIAL MEDIA

Let’s relentlessly connected and get caught up each other.

Looking for tweets ...